5StarsStocks.com is a platform focused on value investing, offering users a curated range of stock recommendations, research tools, and performance insights. While its core mission revolves around helping users discover undervalued investment opportunities, a growing focus has emerged on the defensive strategies users should adopt when navigating any online stock recommendation platform.

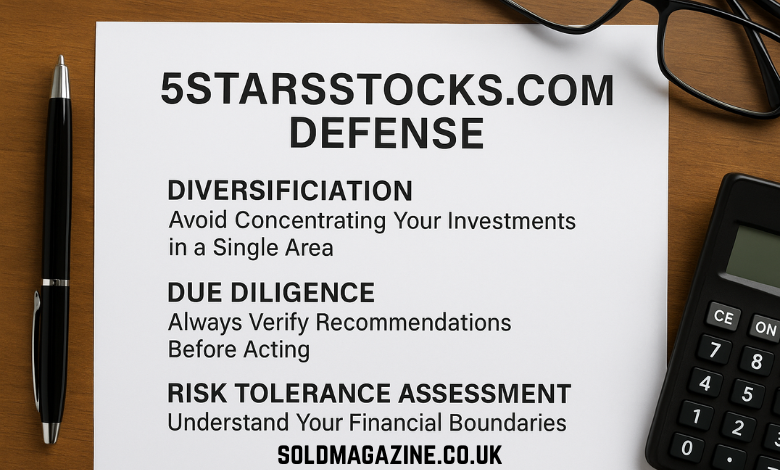

The “defense” approach on 5StarsStocks.com centers around three core principles: diversification, due diligence, and risk tolerance assessment. These foundational pillars aim to help users make informed and balanced investment decisions, avoiding overexposure and mitigating financial risks. This article provides a structured breakdown of each principle and explains how users can implement them effectively while using 5StarsStocks.com.

Diversification: Avoid Concentrating Your Investments in a Single Area

Why Diversification Matters

Diversification refers to the process of spreading investments across various asset classes, sectors, or geographies to reduce exposure to any single area of risk. While 5StarsStocks.com provides focused recommendations often based on long-term value potential, blindly concentrating investments based solely on platform suggestions can amplify risk.

A well-diversified portfolio can absorb individual stock fluctuations without significantly impacting overall performance. For instance, if one stock underperforms due to a sector-specific issue, gains from other sectors may offset that loss.

Types of Diversification Users Should Consider

- Sector Diversification

Users should avoid investing heavily in one industry. For example, investing exclusively in defense contractors like Lockheed Martin or Raytheon—while potentially profitable in the short term—exposes the investor to sector-specific volatility tied to defense budgets and geopolitical developments. - Geographic Diversification

While 5StarsStocks.com primarily covers U.S. equities, defensive investors should consider international stocks, ETFs, or funds to reduce U.S.-centric risk. - Asset Class Diversification

Incorporating bonds, REITs, or commodities like gold can help stabilize returns when equities underperform. - Style Diversification

Mixing growth, value, and dividend-paying stocks ensures that a portfolio benefits from different market environments.

Application on 5StarsStocks.com

While using the platform, users can apply diversification principles by:

- Reviewing sector allocation of each recommended stock.

- Using external tools to identify international or alternative asset opportunities.

- Setting personal allocation targets across sectors or asset types.

Due Diligence: Always Verify Recommendations Before Acting

Understanding Due Diligence

Due diligence is the process of thoroughly evaluating investment recommendations before acting. It involves investigating a company’s fundamentals, understanding the context of the stock pick, and considering macroeconomic conditions.

5StarsStocks.com provides initial screening and rationale for its recommendations, but it’s up to the investor to validate those insights independently. Defensive investing requires skepticism—not distrust—but a healthy need to verify claims before allocating capital.

Steps for Performing Due Diligence

- Company Financials

Read financial statements such as balance sheets, income statements, and cash flow reports. Evaluate metrics like P/E ratio, return on equity, and debt levels. - Management and Governance

Investigate the company’s leadership history, executive turnover, and alignment of leadership interests with shareholders. - Competitive Positioning

Analyze how the company ranks against competitors in terms of market share, innovation, and profitability. - Valuation Cross-Check

Validate the valuation method used on 5StarsStocks.com (e.g., DCF, relative valuation) with alternative models or analyst reports. - Macro and Sector Analysis

Consider how macroeconomic factors, such as interest rates or regulatory shifts, may impact the recommendation.

Caution on Over-Reliance

No platform, including 5StarsStocks.com, can predict the future. Even well-researched recommendations may underperform due to unpredictable variables. Due diligence allows investors to align stock picks with their own understanding and convictions.

Risk Tolerance Assessment: Understand Your Financial Boundaries

Definition and Purpose

Risk tolerance refers to the level of loss an investor is willing to accept in pursuit of returns. It’s influenced by factors such as age, income, investment horizon, and personal psychology. A defensive investor always tailors investments to their personal risk capacity—regardless of market trends or platform recommendations.

How to Measure Risk Tolerance

- Financial Capacity

Determine how much capital you can afford to lose without affecting essential financial goals. - Emotional Comfort

Consider how you typically react to market volatility. Can you withstand a 20% drop in portfolio value? - Time Horizon

Longer-term investors may have higher risk tolerance since they can recover from downturns. Shorter-term investors need safer, more stable assets. - Investment Objectives

Investors saving for retirement, buying a home, or funding education must allocate capital according to goal-specific timelines and risk constraints.

Using 5StarsStocks.com Within Your Risk Profile

- Select stocks that match your volatility appetite (e.g., large-cap value vs small-cap growth).

- Avoid investing in speculative picks if your risk tolerance is low.

- Set limits on position size based on your portfolio’s total value.

- Use stop-loss strategies or trailing stops where appropriate.

Behavioral Discipline

A strong defense also includes emotional discipline. Panic-selling during market downturns or chasing trends during rallies undermines long-term performance. Sticking to a predefined risk tolerance plan prevents impulsive decisions.

Defensive Strategies in Practice on 5StarsStocks.com

Scenario 1: Overconcentration in High Conviction Pick

A user notices that 5StarsStocks.com recommends a strong buy on a technology stock expected to double in 12 months. Enthused by the potential, the user allocates 60% of their portfolio into this one stock. Within months, sector-wide valuation corrections hit tech, and the stock loses 40% of its value.

Defensive Action:

- Apply a 10%-15% cap on any single position to protect against sector-specific risks.

- Pair high-risk picks with stable dividend payers or low-volatility ETFs.

Scenario 2: Blind Trust in Platform Ratings

A recommendation labeled “Strong Buy” is accepted without review. The stock later reveals accounting irregularities leading to a sudden drop.

Defensive Action:

- Cross-verify financial health using platforms like Morningstar, SEC filings, or company investor relations pages.

- Check for recent insider trading activity or litigation history.

Scenario 3: Misaligned Investment Horizon

A young investor with a long-term horizon sells early due to short-term underperformance, influenced by social media panic.

Defensive Action:

- Revisit initial investment rationale and long-term projections.

- Use journal-based tracking to separate emotional reactions from strategic decisions.

Additional Considerations for 5StarsStocks.com Users

1. Beware of Confirmation Bias

Only following recommendations that align with your existing beliefs can create blind spots. Seek counterarguments or opposing analyst opinions.

2. Set Portfolio Allocation Rules

Maintain allocation boundaries (e.g., no more than 25% in one sector, 10% in speculative picks). Rebalance periodically.

3. Monitor and Adjust Regularly

Using tools and alerts from 5StarsStocks.com, set up monitoring for major news, earnings reports, and sector changes.

4. Understand Platform Limitations

No stock screening tool is infallible. Use the site as a starting point, not the final decision-maker.

5. Stay Educated

Stay updated on investment fundamentals. Enroll in financial literacy resources, webinars, or read annual reports to continuously upgrade knowledge.

Conclusion

5StarsStocks.com offers curated, data-driven stock ideas. However, the most value is extracted when investors apply a defense-oriented mindset alongside its use. Diversification ensures that capital isn’t jeopardized by a single sector or asset. Due diligence keeps investors informed and reduces reliance on third-party assumptions. Risk tolerance assessment ensures that the emotional and financial impact of investment decisions remains manageable.

These defensive strategies don’t hinder growth; they serve as guardrails ensuring long-term sustainability. Investors leveraging 5StarsStocks.com defensively are better positioned to capitalize on opportunities without exposing themselves to unnecessary or unmanageable risks.

FAQs

- What does 5StarsStocks.com defense strategy mean?

It refers to using diversification, due diligence, and risk assessment to safeguard your portfolio when following the platform’s recommendations. - How can I diversify while using 5StarsStocks.com?

Combine platform stock picks with other sectors, international investments, and different asset classes to reduce concentrated risk. - Why is due diligence important even with trusted platforms?

No platform is flawless. Validating recommendations helps align them with your personal risk profile and financial goals. - How do I know my risk tolerance?

Evaluate your financial goals, investment timeline, and how much volatility you can emotionally and financially handle. - Does following 5StarsStocks.com mean I’ll avoid losses?

No. Like all investments, there’s risk involved. Defensive strategies help manage and limit potential losses over time.